Wondering what all the buzz surrounding in-store beacons is about? Here, we’re tackling the most frequently asked questions that both shoppers and merchants have about this new technology.

What are beacons?

Beacons are Bluetooth-enabled devices that, when placed in stores, communicate with shoppers’ smartphones with the goal of improving shopping experience by sending relevant real-time ads, coupons and more.

A beacon can scan a person’s phone for information about their shopping habits, preferences, history on the store’s website and more. Stores are using this data to send targeted information that users may find useful while shopping.

How is Bluetooth different from NFC?

It’s important to note that the Bluetooth technology used in beacons is different from Near Field Communication (NFC), a hot technology that’s used for making “tap-to-pay” transactions via smartphone. Here’s a look at he major differences between the two data transfer methods:

| Bluetooth | NFC |

| Longer range – up to 30ft | Shorter range – approximately 4cm |

| Requires more power | Typically consumes little power |

| Requires users to manually connect | Automatically connects in seconds |

| Works best with minimal interference from other devices | Short range makes it ideal for use in more crowded areas |

How do beacons affect shopper behavior?

Let’s say a shopper is walking down the toy aisle looking for Christmas gifts for her son. If her phone is connected to the store’s beacon(s) via Bluetooth, the technology may be able to collect information that she has an eight-year-old son. The beacon will recognize where the shopper is in the store, then respond to the collected data in real-time, sending the customer an advertisement and coupon for Legos, for example. In theory, this personalized, efficient delivery of information will entice the shopper to take advantage of the offer and purchase Legos.

What does this technology mean for merchants?

Beacons will affect stores in two major ways. First, they will improve merchants’ abilities to gather insightful data about their customers’ shopping habits, which will in turn allow stores to tailor their shopping experience to shopper preferences. Second, it will maximize communication between the store and the customer, making the shopping experience more interactive and customized. Think of it like having a showroom sales person in the back pocket of every customer.

How can you use technology to improve the shopping experience?

While beacons are a hot topic, they’re still far from being fully integrated into stores. In the meantime, there are a number of ways that you can use technology to improve the shopping experience for your customers:

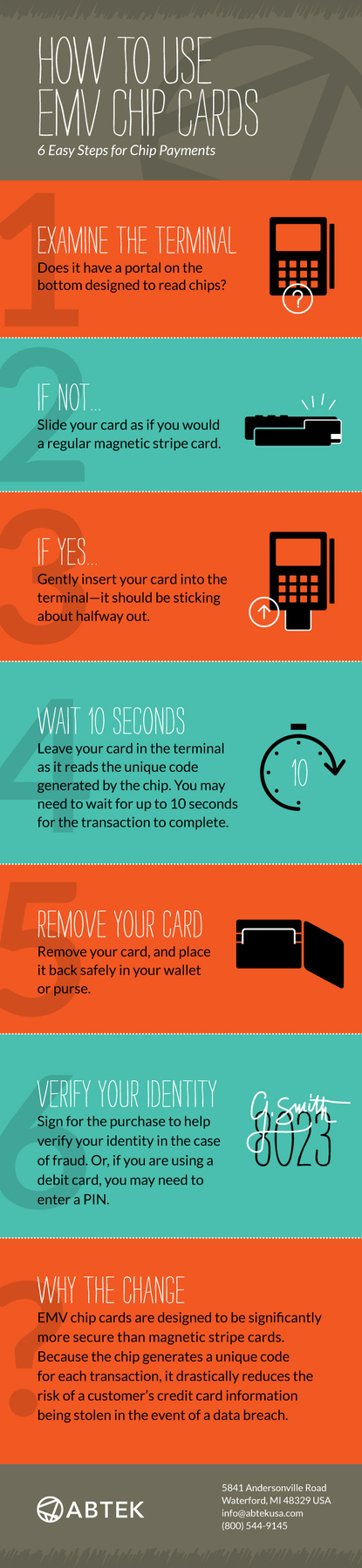

- Upgrade your POS System – If your current POS system doesn’t accept EMV® cards, you could be on the hook for paying for any fraudulent transactions. Plus, many the latest systems include NFC technology, which allows for contactless payments via credit cards and phones.

- Implement a Mobile Loyalty Program – Consumers are all about mobile these days. Give the people what they want by digitizing your paper-based loyalty program.

To stay up-to-date on the latest happenings in the payment-processing world, follow Abtek on Facebook, Twitter and LinkedIn.