Mobile wallets aren’t just on the horizon—they’re already here. Recent smartphone applications have facilitated consumer technology capable of making instant purchases, and the trend may replace commonplace wallet purchasing within the next five years.

Mobile Wallets: The Pros

Mobile Wallets: The Pros

Credit card processing is quick, and it’s reliable. However, mobile wallets—when created and utilized effectively—are incredibly convenient for consumers. Mobile wallets are incredible marketing tools, too, due to their incredible accessibility and mobile purchasing’s increasing popularity. Mobile wallets propose a slew of benefits for consumers, including:

- Ease of accessibility

- Consolidation of funds

- Immediate coupons and savings

- Customer reward programs

The above mention of mobile-accessed coupons is considerably important. An Inmar Solutions trend catcher has depicted an astounding 2.9 billion digital coupon redemption volume. Additionally, approximately 77 percent of shoppers purchased groceries from non-grocer vendors in 2013. Due to a mobile wallet’s wide market accessibility, some of the world’s most vital markets will likely hook into the trend.

Mobile Wallets: The Cons

Mobile Wallets: The Cons

With great accessibility comes high responsibility, and the mobile wallet may propose several problems for future consumers. Merchant services still aren’t accustomed to the change—and several providers may never be.

Additionally, the mobile wallet’s incredible accessibility may pose a problem for some spenders. If you could make a purchase with one quick tap to the phone, wouldn’t you? The following cons also exist within the evolving technology, and it may hold mobile wallets back from their full potential:

- Consolidation of existing technology may cause bugs

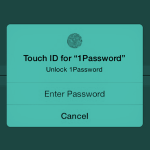

- Security risks from hacking

- Access to high-limit purchases may be imbalanced against credit cards

The infamous cellphone hack scandal in the UK definitely plays upon the above worries. Easy banking accessibility may enable thievery and digitally-stored credit card information may not be safe.

It Isn’t Over for Traditional Payments, Either

In fact, mobile wallets rely upon pre-existing monetary exchange systems. Small businesses can definitely profit from the mobile wallet’s design and functionality, but they’ll need to maintain classic systems and policies to take full advantage of the technology.

Why? Mobile wallets, primarily, connect to a business’s checking accounts. For now, mobile wallets are simply “quick access doors” to business transactions. They aren’t exclusive services.

You’ll Still Need Your Wallet

You’ll Still Need Your Wallet

Mobile wallets can’t just replace fundamental wallet contents. Your driver’s license, registration, insurance card and other important, physical documentation are still required by law. Likely, mobile wallets will never accommodate for such provisions. Simply put: Security, legality and accessibility are important—more-so than a consumer’s ease-of-access to retail spheres. Regardless of a mobile wallet’s capabilities, their boundaries end where life’s other priorities begin.

In many ways, the world still needs physical proof of monetary funds, legal accessibility, health information and other important items. Mobile wallets will definitely play an integral role in retail’s future, but, for now, the leather bi-fold wallet still has a place in your back pocket…and for good reason.

Stay updated on payment processing trends by following Abtek on Twitter and Facebook. Sign up to receive our newsletter, too.