The liability shift has officially hit. Did your business upgrade its equipment in time for the deadline? If not, you’ve probably discovered that the world has not come to an end. However, while you might not feel the effects of the liability shift immediately, becoming EMV-compliant should still be at the top of your priority list.

Don’t just think of it as another task to add to your growing to-do list. By upgrading your equipment and payment processes, you’re truly being a responsible business owner, putting your customers’ data security first. Plus, at the same time, you save yourself the risk of taking on the (costly) liability should a fraudulent charge or data breach occur at your establishment. Here, we’ve rounded up the top three reasons why you should make the switch to EMV-compatible equipment ASAP.

- Avoiding Liability Costs = Greater Profits

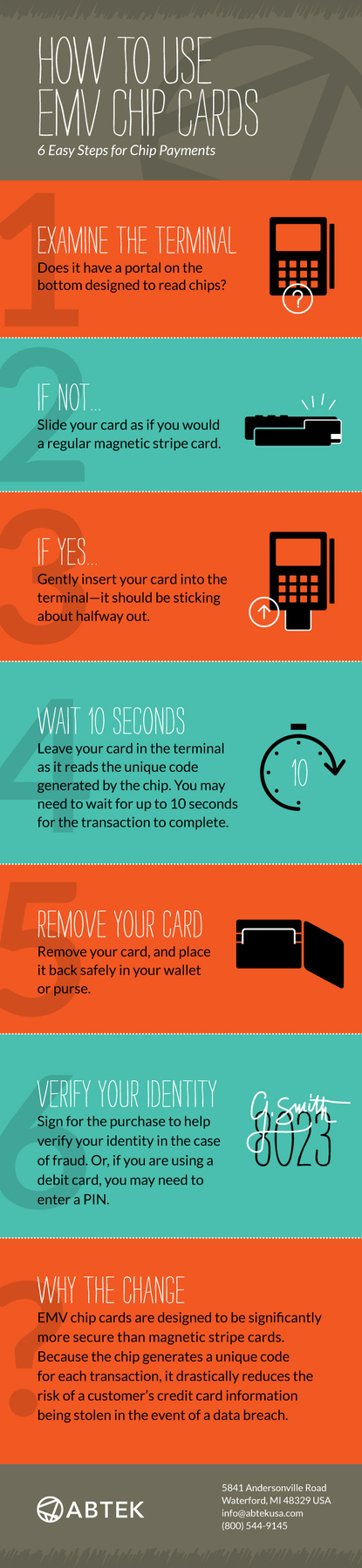

Every dollar counts when it comes to running a business, especially a smaller one. And that’s why it’s so important for merchants to get on board with new EMV terminals. New POS systems are an investment, but it’s certainly an investment worth making. Since the liability shift on October 1, merchants with outdated equipment are now liable for any fraudulent charges made at their store with an EMV chip card. No merchant is completely safe from fraud, but by upgrading equipment, they can avoid liability costs—and at the end of the day, bring home greater profits.

Every dollar counts when it comes to running a business, especially a smaller one. And that’s why it’s so important for merchants to get on board with new EMV terminals. New POS systems are an investment, but it’s certainly an investment worth making. Since the liability shift on October 1, merchants with outdated equipment are now liable for any fraudulent charges made at their store with an EMV chip card. No merchant is completely safe from fraud, but by upgrading equipment, they can avoid liability costs—and at the end of the day, bring home greater profits.

- Meeting Consumer Demands = Happy, Returning Customers

Picture this: It’s the day after Thanksgiving and your store is flooded with customers trying to snag the best deals. A customer finally makes it up to the checkout counter, ready to dip his or her shiny new EMV card, just to find out that they have to use the mag stripe (dun dun dun…). Consumers are smart—they know that it’s more secure to use the chip to make payments than the mag stripe, and they probably also know that your competitor down the street is able to accept the new technology. Chances are, consumers may value the security of their payment data more than the deal you’re offering. Don’t risk losing customers simply because you’re behind the times. Consumers will appreciate the fact that you’re making the security of their data a priority, and you can bet that it will pay off.

Picture this: It’s the day after Thanksgiving and your store is flooded with customers trying to snag the best deals. A customer finally makes it up to the checkout counter, ready to dip his or her shiny new EMV card, just to find out that they have to use the mag stripe (dun dun dun…). Consumers are smart—they know that it’s more secure to use the chip to make payments than the mag stripe, and they probably also know that your competitor down the street is able to accept the new technology. Chances are, consumers may value the security of their payment data more than the deal you’re offering. Don’t risk losing customers simply because you’re behind the times. Consumers will appreciate the fact that you’re making the security of their data a priority, and you can bet that it will pay off.

- New Terminals = Cool New Tech

It’s so easy for POS terminals to fall out of date. You miss one software upgrade and from then on, the technology is unable to live up to its capabilities. Use this opportunity to get a fresh start with your POS system. You can choose to include NFC or contactless payment technology, POS marketing capabilities, and many other perks that you couldn’t justify purchasing on their own. Your new terminals will be easier to manage (your employees will thank you), easier to use (your customers will thank you) and ultimately, they’ll make you look tech-savvy and cool. Bonus!

It’s so easy for POS terminals to fall out of date. You miss one software upgrade and from then on, the technology is unable to live up to its capabilities. Use this opportunity to get a fresh start with your POS system. You can choose to include NFC or contactless payment technology, POS marketing capabilities, and many other perks that you couldn’t justify purchasing on their own. Your new terminals will be easier to manage (your employees will thank you), easier to use (your customers will thank you) and ultimately, they’ll make you look tech-savvy and cool. Bonus!

So, what are you waiting for? The sooner you adopt new EMV technology at your establishment, the sooner you can reap the benefits! Contact your credit card processor today to get started making the transition.