Payment security is at an all time low and as a result, the payment industry is in process of getting a much-needed overhaul. With this rapid implementation of new rules, processes and technology, there are a lot of payment processing buzzwords that have recently entered into the industry vernacular.

As a business owner, you’re busy with your day-to-day operations, so keeping up on the latest payment processing news and trends is probably not at the top of your priority list. However, as these changes could eventually impact your business, it’s never been more important for you to be in the know.

To help you stay updated, we’ve compiled the following glossary of industry buzzwords for your quick reference.

EMV / Chip-and-Pin

EMV is the future of credit card processing, although it’s not exactly so futuristic anymore. If you’re not already aware of the EMV payment revolution happening in the United States, you can read up on the basics here. In a nutshell, over the course of the next few months, banks will begin to roll out new credit cards in an effort to phase out insecure magnetic stripe technology. These cards will be embedded with microprocessor chips that will allow for more secure transactions. But the benefits of these “EMV” or “chip-and-pin” cards won’t come to fruition unless business owners take action now and update their payment terminals.

PCI Compliance

PCI compliance is a term often shrouded in myths and misconceptions, but it isn’t all that confusing once you break it down. PCI is a set of 12 requirements that all merchants, no matter the size or industry, must meet to ensure a secure environment for credit card transactions. If you’re not sure what’s required of your business in order to establish compliance, you’ll want to check in with your merchant services provider or visit the Security Standards Council website.

NFC

NFC

Near field communication (NFC) is the technology that enables wireless data transfers between two devices in close proximity, without the need for an internet connection. Think of it like modern-day Bluetooth. Today’s smartphones are embedded with NFC technology to allow for consumers to make payments directly from their phones by simply tapping or waving their devices over an NFC terminal.

Apple Pay

Apple Pay is a mobile application that is sweeping the nation. Essentially, the application allows consumers to transform their phones into mobile wallets by syncing credit card information from their iTunes accounts. Consumers can simply wave or tap their phones over an NFC terminal (currently available at numerous retailers across the globe) to make a purchase.

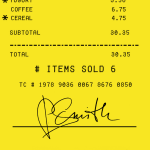

Tokenization

Tokenization

When a credit card is swiped through a terminal set up for tokenization, the card’s Primary Account Number (PAN) is automatically substituted with a randomly generated sequence, called a token. Merchants can use this token to handle refunds, returns and manage other transaction details. The benefit? Tokenization takes sensitive payment card data out of the picture for merchants, eliminating the need to store the data on their networks and the risk of a data breach.

Stay updated on payment processing trends by following Abtek on Twitter and Facebook. Sign up to receive our newsletter, too.