The holiday shopping season is quickly approaching, and you know what they say—“It’s the most wonderful time of the year!” As data indicates, this year should be the most profitable yet, with 82% of merchants expecting their holiday sales to increase from the previous year. Make sure that you’re prepared for the boost in customer traffic (and sales) with these four tips.

1. Adopt EMV Now

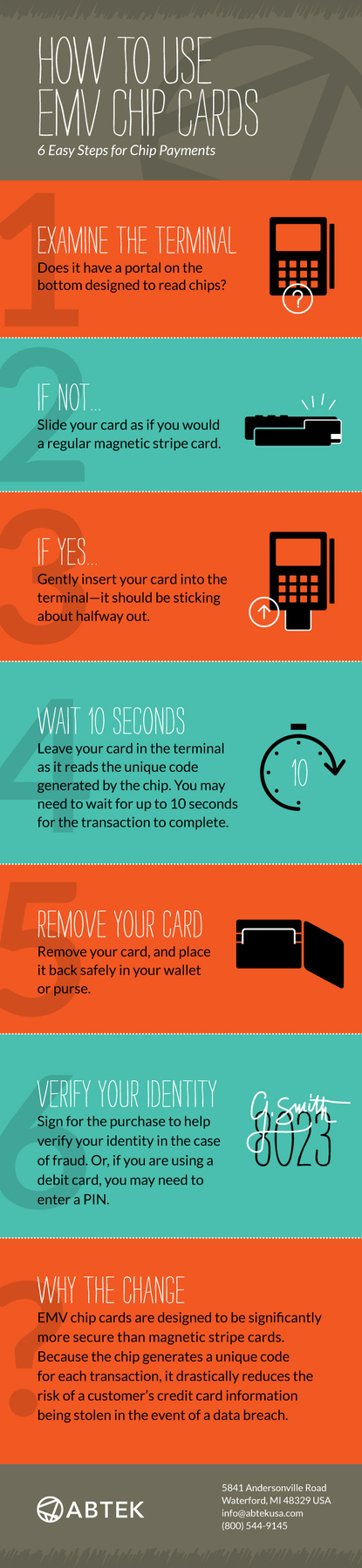

If you haven’t upgraded your POS equipment to for the new EMV chip cards, it’s time to do so. Accepting EMV technology at your store is critical for ensuring the security of your customers’ payment data. Plus, if a fraudulent charge occurs at your establishment, and the victim had a chip-enabled card, you bear the responsibility of paying for the loss. To minimize potential liability, you’ll want to get this installed quickly, before the holiday rush is in full swing. You will need time to properly train your staff on how to use the new system.

If you haven’t upgraded your POS equipment to for the new EMV chip cards, it’s time to do so. Accepting EMV technology at your store is critical for ensuring the security of your customers’ payment data. Plus, if a fraudulent charge occurs at your establishment, and the victim had a chip-enabled card, you bear the responsibility of paying for the loss. To minimize potential liability, you’ll want to get this installed quickly, before the holiday rush is in full swing. You will need time to properly train your staff on how to use the new system.

2. Ramp Up Hiring Efforts to Ensure an Enjoyable Shopping Experience

Lines will be longer than usual, aisles will be more crowded, and as always, customers will be in a hurry. Take measures now to ensure that your customers’ shopping experience will be enjoyable, no matter how busy your store gets. Ramp up your hiring efforts so that you can operate smoothly at full capacity. Consider bringing on specialized employees to assist with decorating the store, gift-wrapping, de-icing any slippery conditions outside and other seasonal needs.

Lines will be longer than usual, aisles will be more crowded, and as always, customers will be in a hurry. Take measures now to ensure that your customers’ shopping experience will be enjoyable, no matter how busy your store gets. Ramp up your hiring efforts so that you can operate smoothly at full capacity. Consider bringing on specialized employees to assist with decorating the store, gift-wrapping, de-icing any slippery conditions outside and other seasonal needs.

3. Make Sure You’re Working with a Payment Processer You Trust

Between the increased customer traffic, extra-large seasonal inventory, and recent changes in payment processing (EMV), things might get a little messy this holiday. When you’re hit with a chargeback, whether “friendly” or not, you’re going to want to be sure that you have a payment processor in place that will fight for you and be available to answer your questions 24/7.

4. Don’t Forget About Gift Cards!

Gift cards continue to be the most asked-for gift item, making the wish list for 62% of shoppers, according to reports from NRF. The average person buying gift cards will spend $172.74. Are you taking advantage of this huge sales opportunity? If you’re still offering paper gift cards, it’s time for an upgrade. Talk to your payment processor about putting a stored value card program in place at your store.

Gift cards continue to be the most asked-for gift item, making the wish list for 62% of shoppers, according to reports from NRF. The average person buying gift cards will spend $172.74. Are you taking advantage of this huge sales opportunity? If you’re still offering paper gift cards, it’s time for an upgrade. Talk to your payment processor about putting a stored value card program in place at your store.

Black Friday will be here before you know it, and if you haven’t begun to prepare, you may already be falling behind the competition. For more tips and tricks on how to prepare for the holiday shopping season, follow Abtek on Facebook, Twitter and LinkedIn! Or, to learn more about your payment processing options, give us a call at (800) 544-9145.