Being able to accept EMV cards isn’t as simple as flipping a switch on your existing terminals. In most cases you’ll have to physically replace your POS equipment to be able to accept these more secure, chip-enabled cards. And with only half of merchants expecting to be ready by the October 1 deadline, there’s a lot of work still to be done.

What does the Liability Shift Really Mean?

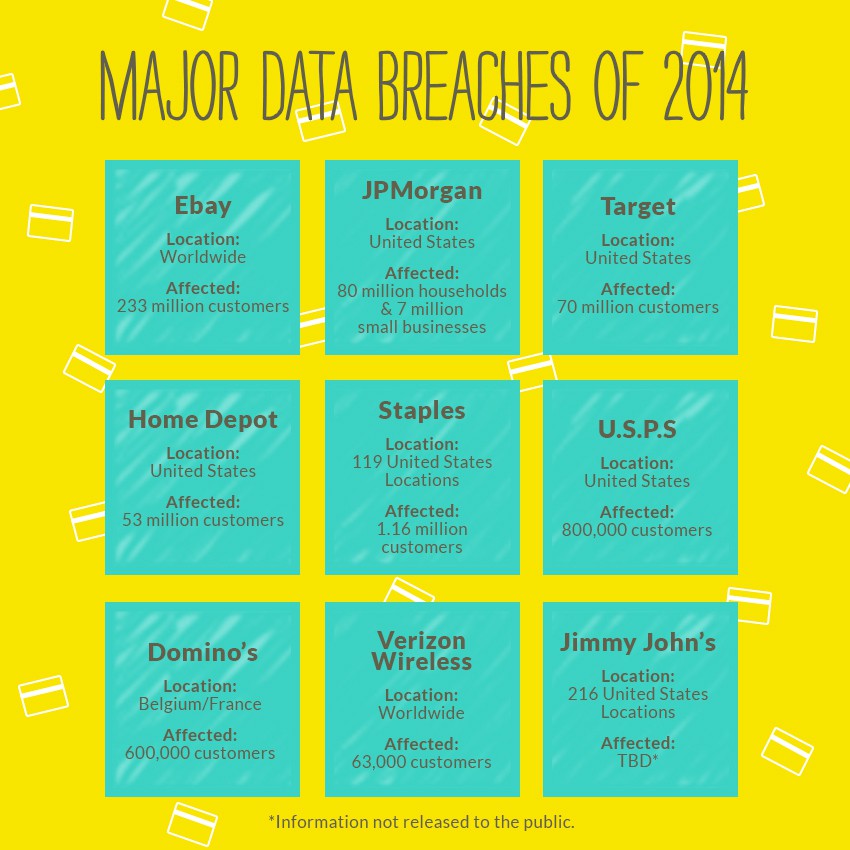

Currently, merchants are at quite a disadvantage when it comes to credit card fraud. In the event of a fraudulent credit card charge, the merchant is first faced with the loss of the merchandise, which in most cases is irreversible. Then, the cardholder’s bank (the card-issuing bank) takes the hit for the lost funds, meaning that they’re responsible for refunding the person who was the victim of fraud. These banks, however, often look to the merchant for reimbursement, claiming that the business didn’t take the proper measures to prevent the fraudulent charge from occurring.

Currently, merchants are at quite a disadvantage when it comes to credit card fraud. In the event of a fraudulent credit card charge, the merchant is first faced with the loss of the merchandise, which in most cases is irreversible. Then, the cardholder’s bank (the card-issuing bank) takes the hit for the lost funds, meaning that they’re responsible for refunding the person who was the victim of fraud. These banks, however, often look to the merchant for reimbursement, claiming that the business didn’t take the proper measures to prevent the fraudulent charge from occurring.

Come October 1, what we know about fraud liability will be flipped upside down. In essence, once the shift hits, the fraud liability will transfer to the party that has not adopted the new EMV chip card technology.

Here’s a detailed look at how the liability shift will affect your business, depending on the situation in which fraud occurs:

Situation 1: A magnetic stripe card is swiped at an outdated terminal

The merchant hasn’t gotten around to updating their terminals, but lucky for you, the fraudulent charge was made with a traditional magnetic stripe card. In this situation, both parties—the merchant and the card-issuing bank—are at fault, meaning that the liability falls initially on the card-issuing bank, just like today.

The merchant hasn’t gotten around to updating their terminals, but lucky for you, the fraudulent charge was made with a traditional magnetic stripe card. In this situation, both parties—the merchant and the card-issuing bank—are at fault, meaning that the liability falls initially on the card-issuing bank, just like today.

Situation 2: An EMV chip card is swiped at an outdated terminal

This is when things really go downhill for merchants. If a customer comes into your store with a chip-enabled card, but they don’t have the equipment to process it properly, they’ll be forced to run it as a magnetic stripe card. This puts the cardholder at an unnecessary risk for a breach of their payment data. In this case, the merchant has not invested in the more secure chip technology and the card-issuing bank has, so the liability falls on the merchant.

Situation 3: A magnetic stripe card is swiped at an EMV-enabled terminal

A recent poll shows that only one in 10 Americans have received new EMV chip cards from their banks. The cost to replace mag stripe credit cards is starting to catch up with the banks and we can expect a number of consumers to still be using magnetic stripe cards, even after the liability shift hits in October. In this case, so long as you have upgraded your equipment, the liability will fall on the card-issuing bank.

A recent poll shows that only one in 10 Americans have received new EMV chip cards from their banks. The cost to replace mag stripe credit cards is starting to catch up with the banks and we can expect a number of consumers to still be using magnetic stripe cards, even after the liability shift hits in October. In this case, so long as you have upgraded your equipment, the liability will fall on the card-issuing bank.

Situation 4: An EMV chip card is swiped at an EMV-enabled terminal

In this situation, all parties have put in the effort to upgrade their payment technologies, so it’s unlikely that fraud would even occur in the first place. However, if a fraudulent charge does occur, the liability would fall on the card-issuing bank.

Contact your merchant solutions provider today to find out how you can get EMV-compliant by October 1.

Abtek is here to help merchants like you make the transition from traditional POS terminals to EMV-enabled equipment. We know that EMV can be confusing, and we’re here to answer all of your questions. Give us a call today at (800) 544-9145 to explore your options, before it’s too late! October 1 will be here before you know it! Follow us on Facebook, Twitter, and LinkedIn.